Disclaimer: This post contains a referral for soCash (Code: WAYN7117, to be applied on signup). This gives you RM5 rebate on your first withdrawal, and I will also get a RM5 rebate after you make your first withdrawal.

Here just for the referral credit? Then use the code, withdraw RM20 once, and call it a day..!

soCash Malaysia Review – As at November 2020

Covid has resulted in me being in Malaysia for an extended period of time, and I was surprised to see that soCash have expanded to Malaysia, as well as Indonesia. I have previously written aboutsoCashin Singapore, so I won’t repeat their concept/business model here, because they’ve replicated it in Malaysia (and I assume, Indonesia).

If you’re looking for a description of soCash, my one-liner is: withdraw money via your bank account at shops, as if they are ATMs. If you want a more in-depth explanation, read the “What is soCash?” section on my first post about soCash.

Summary of soCash in Malaysia:

- Payment Method: FPX (Internet Banking)

- Payment Surcharge: RM0.80

- Minimum Withdrawal: RM20

- Maximum Withdrawal: RM500

- Withdrawal Increments: RM10 (i.e. you can withdraw RM20, RM30, RM40, RM50, etc.)

- Maximum Withdrawals/day: Untested

- Maximum Withdrawals/shop/day: Untested

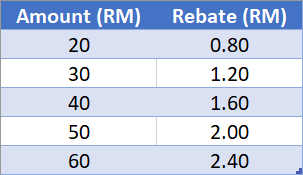

- Rebate: RM0.40 for every additional RM10 you withdraw

- Expiry of rebates: 1 month

At first glance, you’ll probably think “Boo! Payment Surcharge of RM0.80 via FPX!”. However, there is a RM0.40 rebate for every RM10 you are withdrawing, with a minimum withdrawal amount of RM20. This also means the larger the amount you withdraw, the larger your rebate (see table below).

soCash Rebates in Malaysia

Assuming you do one RM20 withdrawal, you’ll pay RM15.80 (factoring in referral rebate) and get RM20 in cash. You then get awarded a RM0.80 rebate in your app to offset your next withdrawal, which offsets the FPX fee.

Coverage & User Experience

I’m currently in Kuala Lumpur – the largest city in Malaysia – and there are actually not that many merchants on the platform. Considering they’ve only been here for no more than a few months (and not to mention, Covid wreaking havoc on “normality”), I suppose this can be forgiven… for now. However, this means that there is a reasonable chance the closest soCash merchant to you is really not that close by!

From my limited experience of using them at two locations so far, the user experience is “acceptable”. I had 7-Eleven staff telling me “you’re our first soCash customer!” and the checkout staff had to summon a senior to help him. On the other hand, at City Milk in Sunway Pyramid, the staff member seemed to know what he was doing!

Is it worth using?

Not really.

I think soCash have a long way to go in Malaysia. I feel that they would probably have been better off trying to solidify their position in Singapore rather than to diversify their focus by branching out into Malaysia and Indonesia.

I’ve said this before, and I’ll say it again – their app design is not the best (app is somewhat buggy), the user experience can be radically improved, and there are too few payment methods accepted. Some alternative paymenth methods soCash could consider are the big eWallets (Boost, Touch n Go eWallet, GrabPay), which I imagine might also offer a cheaper alternative than FPX, and I’d hope would also be a smoother user experience. Some other candidates would include Maybank QR Pay and Shopee Pay.

Final Thoughts

If you happen to have soCash merchants near areas you frequent, you definitely “get” more money than through an ATM. As an example, every RM100 withdrawal gets you a RM4 rebate (or RM3.20, after the FPX fee) – and this rebate increases, the larger your withdrawal amount.

However, I would argue the user experience, at this point in time, is probably still not going to pull you away from using ATMs, especially with the inter-bank ATM fees waived during the MCO. The process and app experience is a still a little too fiddly to recommend soCash to be a viable replacement for ATMs, but if they can get substantially more merchants on board, offer more payment methods, and polish up their app experience – only then do I think they can be considered a viable alternative to ATMs.

If you’re just after the RM5 referral credit, go sign up and do one withdrawal! Otherwise, you’re probably better off sticking to ATMs.