Last Updated: 9 March 2021

Disclaimer: This post contains a referral link for ZA Bank and Transferwise. For ZA Bank, the referral code, “DBN5D4“, gives me $100 HKD when you open an account successfully. You will also get $100 HKD if you spend (any amount, I believe) with your ZA Card within 14 days of opening your account!

For TransferWise:

- Your first 1000AUD (or equivalent) will be transferred for free (so you should definitely use it for your HKD transfer!)

- I will earn a reward for every 3 people that sign up and transfer the equivalent of more than 300AUD through their platform

I have also written a review on TransferWise.

[Hong Kong] Are you a Hong Kong Permanent Resident/Citizen Currently Overseas? How to Claim $10,000 HKD Government Handout when Overseas – as at March 2021

So you…

- Are a Hong Kong Permanent Resident

- Are not in Hong Kong, and can’t/won’t go back any time soon

- Do not have a Hong Kong Bank Account

- Want the $10000 HKD that the Hong Kong government is giving out

Registration for this $10,000 HKD government handout has been open since 21 June 2020, and is available until 31 December 2021.

I managed to figure out what is probably the easiest way for you strugglers.

This method is possible thanks to the virtual banking licence of ZA Bank.

This is not a step-by-step guide, because the ZA Bank app does a pretty good job of guiding you through every step of the way, all the way through to getting the $10,000 HKD cash hand out.

Instead, I’m going to share some solutions to obstacles I encountered along the way to getting the $10,000 HKD, as well as some questions and answers to some common questions/concerns that came up throughout my journey, and that of my family/friends when I shared this process with them.

Pre-Requisites

- Be an eligible Hong Kong Permanent Resident or Citizen

- Have access to a Hong Kong Phone Number that is not currently linked to a ZA Bank account (for verification)

- Download the ZA Bank App (iOS/Google Play Store) on your phone

- Have your physical Hong Kong ID Card with you when you’re opening your ZA Bank account

The trickier parts of this process are getting access to a Hong Kong Mobile number, and downloading the ZA Bank App on Android, so I’ve written dedicated sections on how to navigate these obstacles below.

The rest of the process is quite straightforward, thanks to the nicely designed ZA Bank app, which has a nice UI and UX. It makes the entire process quite seamless!

How to Gain Access to a Hong Kong Number

The easiest way is via WeChat:

- Download WeChat

- Open an account

- On your WeChat home screen, select the “+” in the top right corner, and then “Add Contacts”

- Select “Official Accounts”

- Search for “Multibyte”

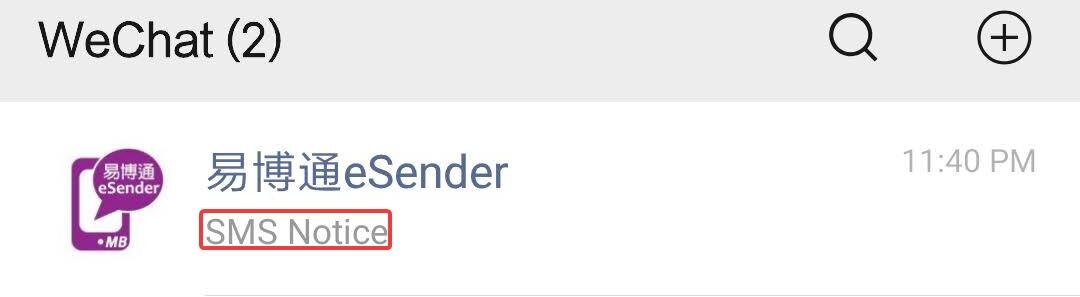

- Look for “易博通eSender” and tap on it, then “Follow” (thanks Jake Wood, from the comments)

- This allows you to actually receive the SMS via WeChat via a communication link

- While still on the 易博通eSender page, select “eSender” and then “Registration Service”

- Select “Hong Kong Number”

- Select “Registration Service”

- Select “No SIM(SMS for WeChat Only)”

- Fill in your contact details – it doesn’t require any verification, so I guess you could put a fake number in

- For Promotion Code, enter CK8888 – this gives you an extra 15 days (I get nothing for this!)

- Select the option you want. I picked HKD18/30 days.

- Select a phone number

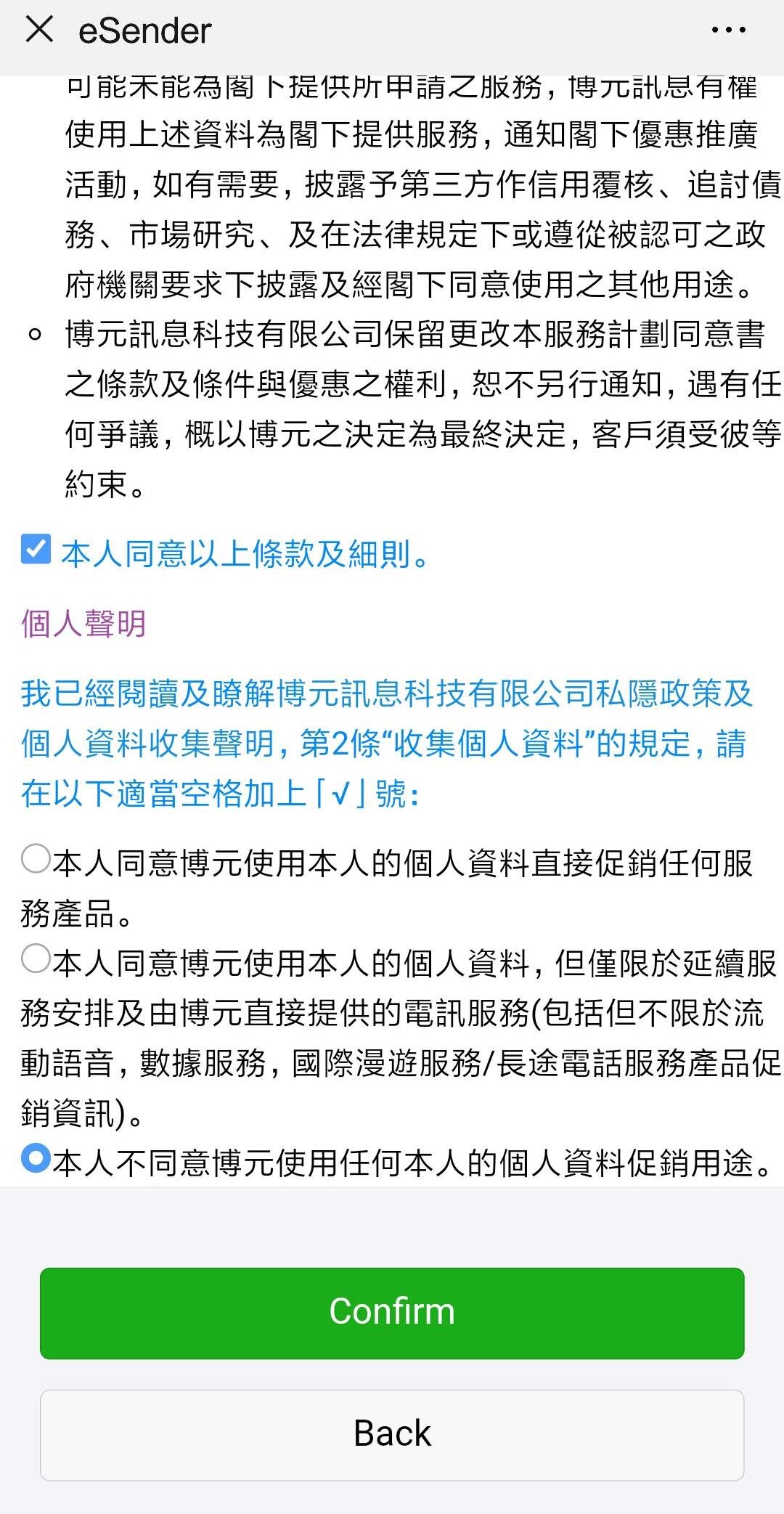

- The next screen is the T&Cs, and is almost entirely in Chinese. Agree to the T&Cs (the first checkbox), and then select the very bottom option out of the 3 radio buttons

- The 3 radio buttons are responses to, “do you agree to allow your details to be shared with third party providers etc.?”, and the bottom option is “No, I do not agree.”

- Refer to the screenshot and the text shown just in case, because this could move around!

The T&Cs in Chinese, and what you need to select

- Go through and complete the payment. I assume PayPal will be most convenient for those overseas. There is no surcharge for paying with PayPal.

- A reminder to use either a card that charges in HKD so you don’t incur foreign transaction fees, or use a card with no extra foreign transaction fees applied, and ensure you select PayPal to charge you in HKD rather than convert to your local currency.

- This is because the exchange rate applied by PayPal will likely be worse than the rate applied by your card provider.

- After completing payment, you should see a screen in Chinese which confirms that your payment has successfully gone through. Look for the words “状态: approved” which means “Status: approved”. You can now press “返回” (go back) at the bottom.

The confirmation page

- You should see a screen which says “Welcome to eSender” with your phone number, balance, and date of expiry (listed as “Validity”).

- Finally, any SMS you receive will now appear on your WeChat home screen as if you’ve received a message.

The phone number cannot be used across multiple ZA Bank accounts. I’ve already tried, so you don’t have to 🙂

Other, less ideal options are:

- Purchase a “virtual” Hong Kong number that is capable of receiving SMS. However, I personally have no experience with this, so I have no service to recommend. Just google something like, “virtual hong kong number for receiving SMS”

- In practice, this should work in a similar manner to that of WeChat, but from my brief search, costs a little more.

- Use a relative’s/friend’s number, and coordinate time with them to be available to provide you with the verification code sent from ZA Bank when you are opening the account.

- Because only one number can be used with one ZA Bank account, if your relative/friend intends to open a ZA Bank account themselves in the future, this will prevent them from using this number!

- Get a relative/friend who lives in Hong Kong help you buy a local Hong Kong SIM card, and then coordinate time with them like in the option above.

- The cheapest SIM, I believe, is ABC Mobile at $38 HKD for 6 months. If you can find a cheaper one, then get that (and let me know, so I can update this!)

- Use a free SMS website, which includes a variety of numbers capable of receiving a SMSes without owning the number. However, I do not at all recommend this option, because there is a very real risk of others being able see the verification codes, as the SMSes are all publicly visible to anyone who visits the page. There is also the possibility that someone else has already used the same number, so you might not even be able to use the number!

- If you insist, here was the Google query I used, and here is one website, here is another and finally one more

On the balance of convenience, cost, and practicality, I’d pick the WeChat method, because it’s the cheapest method that you can do entirely by yourself, without bothering someone else (much)!

How to Download the ZA Bank App on an Android Device

So you’ve searched the Google Play Store, and you can’t find the ZA Bank app. You can try click on that link on your Android device – but does it say, “This item is not available in your country”?

You can try change the country of your existing Google Account, but it’s a lot of hassle (and you can’t change it back for a year). You can open a new HK Google Account, but that requires VPN.

The easiest way is to go to the ZA Bank Homepage on your Android device, scroll to the very bottom and click on “Download APK File”. Or, just click here (I’ve linked to where that button links to).

After downloading the APK file, you must open it and authorise your device to install it – you may need to tweak some security settings to allow APKs/apps to be installed from “Unknown Sources”

Concerned about these security warnings/tweaks? Read on – here are some common concerns/questions/obstacles!

FAQs/Common Concerns

- Question: Is this download APK method legit/safe?

- Answer: It’s on the official website of ZA Bank, so I would not be concerned. The security warnings you get when opening this APK file are built-in protections that Google have implemented into Android to try to protect you from installing unrecognised apps from unrecognised APK files, but given this is the APK file supplied on the official ZA Bank website, I wouldn’t be concerned with the legitimacy of the APK.

In other words, if you’re concerned about this APK file, then it shouldn’t be because it’s a “random APK file”, but because you’re skeptical about ZA Bank as it is!

- Concern: When trying to register my WeChat eSender MultiByte number for a ZA Bank, it says the number is already in use.

- Answer: This seems to be becoming a common issue, and I encountered this myself because my previous number expired, so I bought a new number and tried to change my existing number but it had been used. From my understanding, this is because many have been using this method to get a virtual HK number to “qualify” for this particular step of the registration and eSender/MultiByte are recycling their numbers. I would try to get in contact with them over:

- Email: [email protected]

- Phone: +852 2156 6888 (they have Cantonese, Mandarin and English language support)

I tried to call them on their English and Mandarin line but I was on hold for over 2 hours, so I gave up and sent them an email. I was given a replacement number 24 hours later which worked.

- Concern: I’m in the US and WeChat might get (is?) banned. Any alternatives for me to get a HK number?

- Answer: I am not familiar with the intricacies and technicalities of the proposed ban. For example, has it just been pulled from the Play/App store, or have the US actually blocked WeChat servers? If it’s the former, here are some other ideas:

- Use a non-US Google account to download WeChat from the Play Store

- Download the WeChat APK from outside the Play Store, but tread carefully if you go down this path

Otherwise, I stumbled upon a YouTube video that proposes using another app which only has a Chinese name, 无忧行 in Simplified Chinese/简体中文, or 無憂行 in Traditional Chinese/繁体中文. The app also appears to be 100% in Chinese. However, it does not exist in Google’s Play Store. You can supposedly get it via APK Pure, which I believe is a third party app-store – and we’re getting into technical territory here. I have no personal experience using this so I cannot advise further. The virtual HK number through this app costs a little more than the WeChat method, unless you get the 7 day option.

- Question: What should I put as my Tax Jurisdiction/Residency and Nationality?

- Answer: As far as I am aware (based on a friend’s experience), it doesn’t matter what you pick as both your tax residency status and Nationality, as neither plays a role in your eligibilty. However, to be safe, it’s probably best you just put HK.

- Question: I don’t have my physical Hong Kong ID on me. Will a photo/PDF of it work?

- Answer: No, because the app will check the authenticity and “3D-ness” of your card through a scanning mechanism as part of the verification process.

- Question: I can’t open a WeChat account without having a friend verify me.

- Answer: Get a friend who uses WeChat and is eligible to help you perform this verification. If you don’t have any direct friends who can help you out with this, maybe try some online communities/forums to find someone. Otherwise, maybe try reach out to me on Facebook and I’ll help you if I can, or consider one of the alternative options (sorry!)

- Concern: I don’t want to use ZA Bank because I have not heard of them/they are Mainland Chinese owned/I want to use a larger or more established bank

- Answer: I’m not here to promote ZA Bank, so I won’t go on a spiel about how safe they are, have X million customers, etc. The point of this is to be able to open a Hong Kong bank account when you’re overseas. ZA Bank, at the time of writing, is the only “Virtual” bank in Hong Kong. All the other “real” banks I looked at require you to physically verify your identity at a physical branch (in Hong Kong, of course) within 30-90 days of opening your account online. I am not able to do this, so ZA Bank were my only option.

- Concern: I don’t want to leave my money in ZA Bank after I receive it.

- Answer: Move the money out to a relative/friend’s account temporarily, or look into moving it overseas using a third party transfer company like CurrencyFair, InstaREM, Transferwise

If you are trying to “time the market” and get the best transfer rate possible, firstly, that’s pretty difficult, but if you still wish to try, just be aware the HKD to pegged to the USD at a range of 1:7.75-7.85, so roughly speaking, when the USD is doing well, so is the HKD. The inverse will of course also be true.

Given that you can get a Virtual Visa card immediately, you can also just spend the money directly from the account. As an added bonus, there’s a 6% rebate for online transactions, so keep that in mind! Just take note of the 1.95% overseas transaction surcharge, which still ends up being a net 4.05% rebate.

Based on several test transactions I made in late November, the rate ends up being within 0.20% of the quoted 1.95% fee on foreign transactions. This is based on using xe.com’s mid-market rate as a benchmark, and means the forex fee charged by ZA Bank is very reasonable.

- Concern: I do not have a Hong Kong Residential Address

- Answer: Use a friend’s/relative’s. If you put an overseas address, I think there is a chance you may get your request for the $10,000 HKD payout declined, so I wouldn’t risk it. Their services are supposed to only be for those living in Hong Kong, after all.

- Question: But I don’t really live at that address, so I have no evidence/bills/statements that show my name at that address.

- Answer: You are not required to provide proof of address, but they could ask for it in the future, I guess. I don’t have a real practical solution for this.

- Question: For the physical ZA Bank Card that was announced in late November 2020, can that be sent overseas?

- Answer: Yes – well, the app let me put in an overseas address, but it also resulted in the estimated delivery date changing from 1.5 weeks to 3 months. I tried two different countries and both showed 3 months.

- Question: How do I withdraw money from my account from an ATM?

- Answer: You have to get hold of your physical card first, and then use the card at a ATM. However, since you’re reading this article, I assume you’re not in Hong Kong, so I’d recommend you send it to an alternative HK bank account (such as that of a friend’s/family member’s) and withdraw from that account instead. I would not recommend you withdraw using overseas ATMs due to fees.

- Question: Do I have to maintain the HK number I use with ZA Bank?

- Answer: Not if your sole purpose is to receive this $10k HKD and not use this ZA Bank account. From my experience, you’ll need to enter a verification code on your registered number for the following purposes:

- Customer enquiries over the phone may involve the customer service agent sending a verification code to the saved mobile number to be read back to the agent (I called twice and was asked for it once, and wasn’t asked it for the other time)

- Changes to your account-related transfer limits

- Money transfers

- Logging in on a new device if face verification method fails

Update: 23 September 2020 – However, it appears that you may not require the verification code if you have ZA Bank configured to accept fingerprint authorisations. I managed to update my transfer limits and register a payee without a verification code on my number, but by using my phone’s saved fingerprint instead.

- Question: Can I just use my overseas phone number?

- Answer: No, because the app does not even give you the option of changing the country/area code from +852 to anything else. You can’t change it after you create your account either.

- Question: How long will it take for my account to be approved?

- Answer: It will probably take anywhere from being almost instant, to about a week. If it takes more than a few days, I highly recommend you find a way to call their customer service (available in Mandarin, Cantonese and English) to find out what’s happening.

- I had to do this after about 4 working days. I was getting worried as my account still hadn’t been approved, and I found out it was because the format of my address was not entered correctly.

- Question: Should I register my Hong Kong number for FPS (Faster Payment System)?

- Answer: Not if you are using a friend’s/relative’s number, and probably not if you have no intention of maintaing this phone number long term.

- Question: How long will it take for me to receive the $10,000 HKD?

- Answer: It depends on when you enroll yourself for it, but I’d probably rely on the official sources for estimated turnaround time. For me, it took about 1.5 weeks.

- Question: Can/will ZA Bank close my account since I’m overseas?

- Answer: It’s not impossible, but I’d say it is unlikely. ZA Bank is supposed to only be for those living in Hong Kong, so if they somehow pick up on the fact that you aren’t actually in Hong Kong, and you can’t provide any proof of address (if prompted), then I’d say there is a chance it could happen.

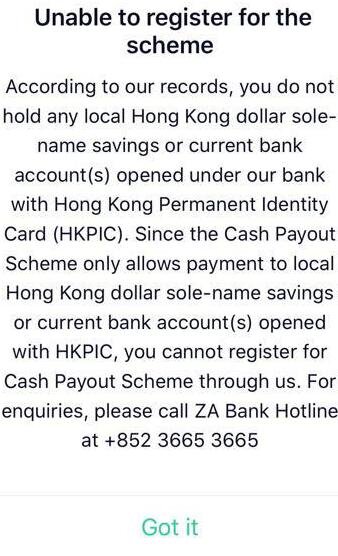

This error probably means your ID card was not successfully scanned as a Permanent HKID by the system

- Concern: When trying to enroll for the $10,000 cash handout via the app, I am encountering the following error:

Unable to register for the scheme.

According to our records, you do not hold any local Hong Kong dollar sole-name savings or current bank account(s) opened under our bank with Hong Kong Permanent Identity Card (HKPIC). Since the Cash Payout Scheme only allows payment to local Hong Kong dollar sole-name saings or current bank account(s) opened with HKPIC, you cannot register for Cash Payout Scheme through us. For enquiries, please call ZA Bank Hotline at +852 3665 3665″.

- Answer: My friend encountered this issue. The reason this happened is because his HKID card incorrectly scanned as a non-permanent HKID, and one of the eligibility criteria is to be a Hong Kong Permanent Resident. He had to call up the ZA Bank number (as listed) to get it fixed. It took a few days to fix, but once it was changed to a Permanent HKID, he was then able to register successfully for the $10,000 cash handout.

If you do not wish to make an overseas call (why would you want to?), you could try emailing them, but I’d expect it to take longer to fix, so it might actually be worth finding a way to call ZA Bank. Their customer service does have an English language option!

- Concern: When I open the ZA Bank app, it says it needs to be updated, but I have an error saying “This item isn’t available in your country” in the Google Play Store

- Solution: Re-download the APK file from the official ZA Bank website, just as you did when you first downloaded the app. Open the APK file once you download it, and install the app. It may ask you to confirm you wish to replace the existing app – to which the answer should be yes!

- Question: How do I close my ZA Bank account?

- Answer: As per their FAQ “If I want to close my ZA Bank account, what should I do?”, “Please contact our Customer Services at 3665 3665 to request for account closure.”

Please let me know if this helped you as I’d really love to hear that my content was useful! Facebook, comment, or whatever medium you like!

Search terms: hong kong 10000 overseas, hkd 10000 overseas, 10000 hkd from overseas, 10000 hkd government currently overseas, how to get 10000 hkd when overseas, $10000 hong kong hand out

Massive thanks for detailing this process. I would add a note to the WeChat esender procedure to "Follow" that official account, which opens a communication link with it, or else it won’t notify/send you the SMS even if you receive one (might be useful to know for people who don’t often use WeChat).

Thanks for that tip! I’ll update the article to include this bit of detail!

My mom has an older HK permanent ID card(not the smart one). Would that eligible to register ZA bank and ultimately received that $10000HKD

Yes. Source: My entire family including myself are holders of the non-smart one, and all of us were fine. You’re also specifically asked to select your HKID type during the verification, so absolutely it’s allowed.

Hi, just tried to register about a week ago and all was good, then tried to use the Cashout Scheme function. ZA stated that they wanted 3 to 5 days to verify account. After 3 days, error message came up. Called ZA and they said they called the WeChat HK phone number but since no one answered, they cancelled the account and would have to reapply after 2 weeks. They will also call to verify the phone number so they told me to have my phone on all the time. But can’t receive calls from the HK phone number on WeChat. Any one experience this problem? I wonder if they caught on…

I have not experienced this.

I can’t think of any obvious solution to this, except to provide a number of a family member or friend up until after the $10,000 HKD cashout scheme money is paid, before then changing it to a WeChat number. What exactly did the error message say?

I forget but it was something along the lines of you did not pass our internal review. Today received email that said ‘We regret to inform you that your information provided in the account opening application did not pass our internal review. We have tried to contact you by phone but in vain. Therefore, we have already suspended your account and you can no longer deposit or withdraw funds with your account.’ I wonder if they caught on and started calling people in addition to sending SMS.